What Really Drives Rebar Prices: A Contractor’s Guide to Reading the Steel Market

- Tribe Distribution DMCC

- Oct 7, 2025

- 5 min read

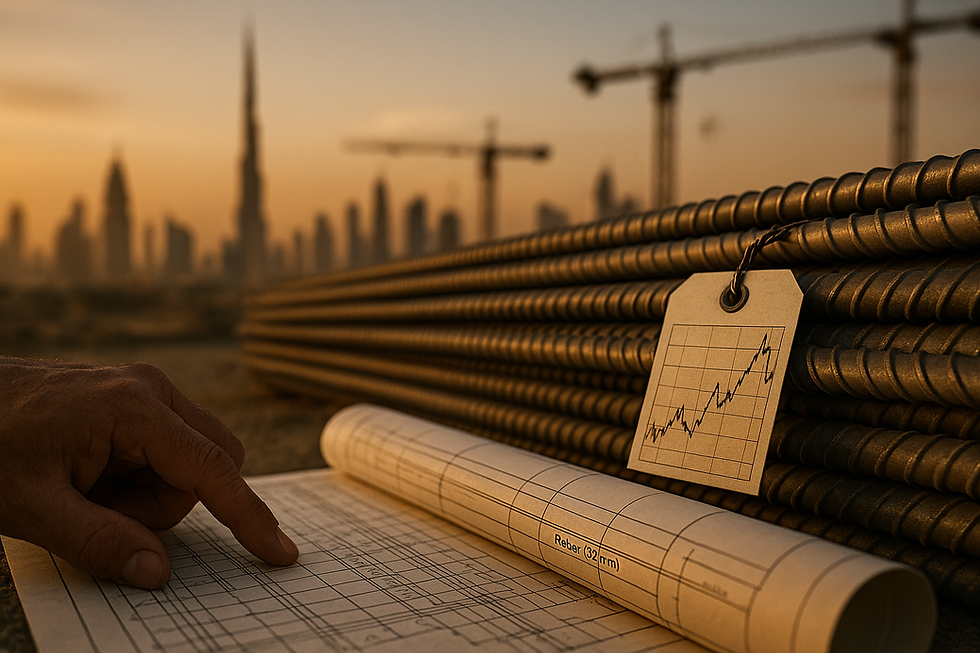

1. Why Contractors Must Read the Market, Not Just the Price

Every contractor in the UAE is familiar with this situation: one week, rebar costs AED 2,320 per ton, and by the time the next tender arrives, the price has increased to AED 2,420, without any clear reason.

But rebar prices don’t move at random. Behind every fluctuation is a chain reaction — from scrapyards in Europe, to rolling mills in Turkey, to demand shifts on UAE project sites. Understanding these forces is the difference between buying reactively and procuring strategically.

At Ferrum Steel Solutions, our goal is to make that chain visible — so you can anticipate movements, protect your margins, and time your purchases with confidence.

2. The Global Cost Engine: Where Every Dirham Begins

Every rebar bar rolled in the UAE starts its life as part of a global equation of raw materials, freight, and currency. Here’s how that equation plays out:

1. Why Contractors Should Understand the Market Beyond Just Prices

Contractors in the UAE often encounter this scenario: one week, rebar costs AED 2,320 per ton, and by the next tender, it rises to AED 2,420 without any apparent reason.

Yet, rebar prices don't change randomly. Each fluctuation is part of a chain reaction—from scrapyards in Europe to rolling mills in Turkey, and demand shifts at UAE project sites. Understanding these dynamics distinguishes reactive buying from strategic procurement.

At Ferrum Steel Solutions, we aim to clarify this chain—enabling you to anticipate changes, safeguard your margins, and time your purchases confidently.

2. The Global Cost Engine: The Origin of Every Dirham

Every rebar in the UAE begins as part of a global equation of raw materials, freight, and currency. Here's how this equation unfolds:

a. Scrap Prices – The Foundation

Scrap metal is crucial for steel production, particularly for electric arc furnace (EAF) mills—prevalent in Turkey, India, and the GCC. When European or U.S. scrap prices increase by $10 per ton, UAE rebar prices typically rise by AED 15–20 per ton. This is because Turkish mills, the region's main suppliers, face higher raw input costs, which are passed down to the region.

b. Billet Prices – The Midpoint

Billet, the semi-finished steel that becomes rebar, is mainly imported by the UAE from Turkey, Oman, and India. If Turkish billet prices rise from $480 to $500 per ton FOB, the landed cost in the UAE increases by AED 35–40 per ton, even before mills add rolling and logistics costs. When billet supply tightens, UAE rebar mills either raise prices or limit allocations, impacting project budgets.

c. Energy and Freight – The Concealed Factors

High oil prices increase energy and shipping costs. For instance, a freight increase from $20 to $35 per ton on Turkish cargoes can add AED 50–60 per ton to the rebar cost. Energy-intensive processes—from melting scrap to bending bars—are also affected when regional power tariffs change.

d. Exchange Rates – The Quiet Influencer

Currency fluctuations play a significant role. When the Turkish Lira weakens, Turkish exports become cheaper for GCC buyers. The opposite occurs when it strengthens. The same applies to the Indian Rupee, especially affecting billet and long steel exports to the Gulf.

3. The Regional View: Who Determines the GCC Benchmark?

While global factors are significant, it's the regional supply dynamics that set the market floor and ceiling for UAE prices.

a. Turkey – The Regional Price Leader

Turkey is the GCC's reference point for both billet and rebar exports. When Turkish mills increase export offers—often in response to tight scrap supplies—GCC import parity rises. Local UAE mills usually align their prices within AED 20–30 per ton of Turkish parity levels.

b. India – The Nimble Competitor

India is a versatile supplier of billet and rebar, often filling gaps when Turkey faces logistical or cost challenges. However, strong domestic demand, especially from Indian infrastructure projects, often limits India's export volumes, creating short-term supply gaps in the GCC.

c. China – The Global Moderator

Even when China doesn't directly ship to the UAE, its export policies and production cuts influence global billet sentiment. A decision in Beijing to restrict steel output can elevate billet prices across Asia within days, affecting UAE rebar parity almost immediately. Conversely, when Chinese mills supply Southeast Asia with cheap billet, GCC buyers benefit.

d. Oman & Egypt – The Regional Support Players

Omani mills, like Jindal Shadeed and Sohar, play a crucial role in balancing GCC supply. Egypt's exports are limited by currency and inflation pressures, though occasional shipments affect North Africa–GCC trade flows.

4. The Local Equation: What Makes UAE Prices Distinct

Once global and regional costs are settled, local market factors determine the final price contractors pay.

a. Mill Competition & Capacity

The UAE's leading producers—EMSTEEL's Emirates Steel, Conares, and Union Iron & Steel—set the domestic tone. Their pricing strategy balances import parity with local demand. When demand is strong and imports are limited, local list prices increase.

b. Project Pipeline & Demand

Dubai's private real estate projects and Abu Dhabi's infrastructure pipeline, especially under Vision 2030, ensure resilient demand. Tender slowdowns, holidays, or summer site inactivity can temporarily reduce local rebar demand, often leading to stable or discounted mill prices.

c. Fabrication & Cut-and-Bend Services

For contractors, the actual cost isn't just the mill gate price. Fabrication (cut, bend, tagging, delivery) adds AED 100–200 per ton, depending on bar diameters, scheduling, and on-site delivery requirements. Fabricators' energy, logistics, and manpower costs also rise with base steel prices.

d. Government Policy & Trade Environment

The UAE's zero import duty keeps the market open and competitive. However, anti-dumping controls and sustainability policies, such as the rise of green steel standards (LEED, Estidama), may start influencing sourcing decisions and cost differentials in the future.

5. How to Interpret the Market Moving Forward

For contractors, the key isn't predicting exact prices—it's recognising which signals to monitor. At Ferrum Steel Solutions, we track these indicators weekly:

Indicator | Why It Matters |

🇹🇷 Turkish rebar & billet export prices ($/t FOB) | The benchmark for GCC parity. |

🇨🇳 Chinese billet export offers & SHFE rebar futures | The global sentiment driver. |

⚓ Freight rates (Baltic Dry Index) | Indicates shipping cost trends. |

♻️ Scrap prices (Turkey HMS 1/2 80:20) | The base cost of production. |

🇦🇪 Local project tender data | Predicts domestic demand direction. |

Ferrum Tip:

When Turkish rebar offers rise by $10–15/t while scrap remains stable, it usually indicates tightening margins—and a potential AED 20–30/t increase in UAE rebar within 1–2 weeks.

6. The Conclusion: Knowledge is Power

Rebar prices follow logic—not luck. They reflect a global network of costs, capacity, and competition that contractors can learn to interpret.

By tracking the right signals and understanding regional connections, UAE construction professionals can make more informed procurement decisions, reduce risk, and protect profit margins.

At Ferrum Steel Solutions, we convert global steel data into clear, actionable intelligence—helping you stay ahead of market changes.

🔹 Follow Ferrum Steel Solutions for weekly Market Pulse insights on UAE and GCC rebar prices. Because timing matters—and knowledge builds stronger foundations.

Comments